Introduction

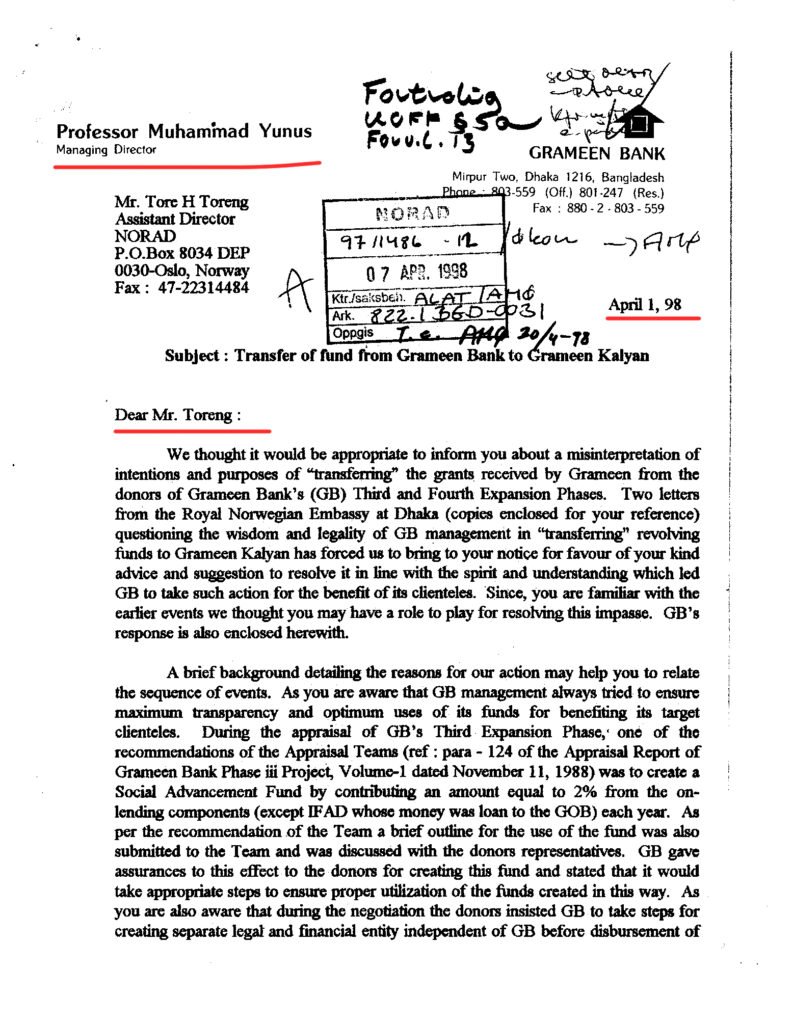

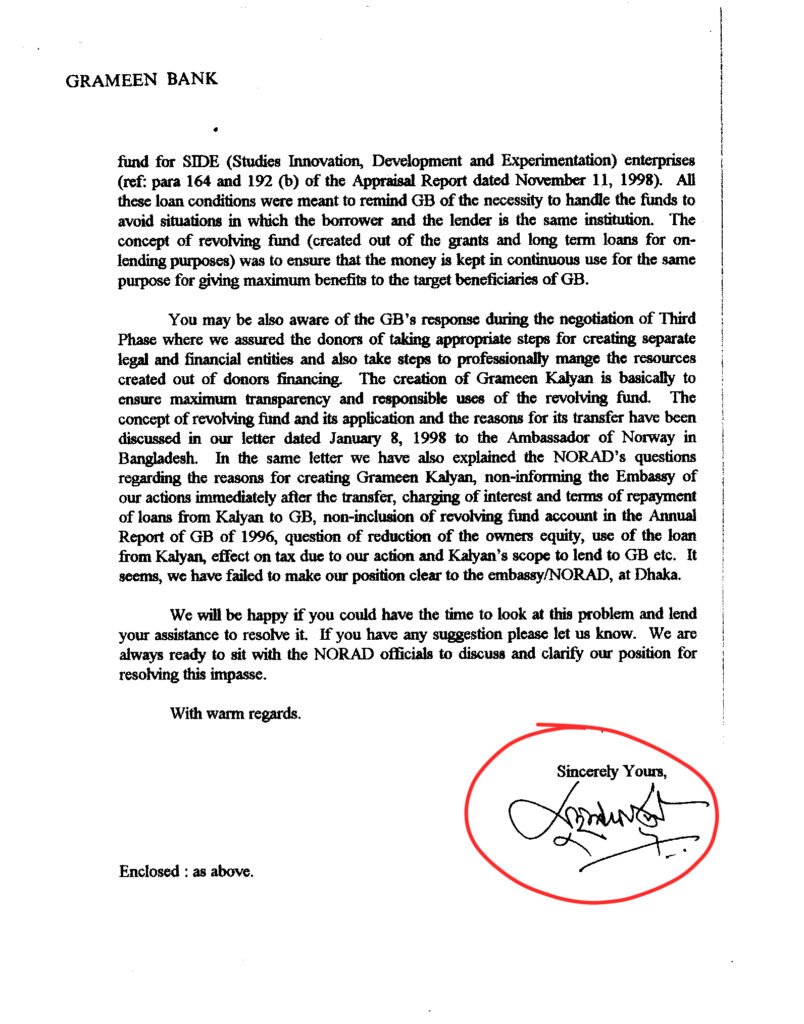

This letter was written 27 years ago, in 1998, by Professor Muhammad Yunus. He addressed it to Tore H. Toreng, then Assistant Director of NORAD (the Norwegian Agency for Development Cooperation).

Context of the Letter:

NORAD, a Norwegian aid agency that provides humanitarian support worldwide, granted nearly $100 million to strengthen the operations of Grameen Bank. Instead of keeping the funds within Grameen Bank, Professor Yunus secretly transferred them to a separate entity he created, called Grameen Kalyan. His goal, as later revealed, was to avoid paying taxes to the Bangladeshi government.

When this came to light, NORAD and the Norwegian Embassy raised serious questions. In response, Yunus wrote this letter. But instead of giving a transparent explanation, he attempted to obscure the facts with evasive and misleading arguments.

Here are the most problematic parts of his letter — and why they matter.

1.

“… a misinterpretation of intentions and purposes of ‘transferring’ the grants received by Grameen from the donors … to Grameen Kalyan …”

Analysis: This minimizes the issue as a mere “misinterpretation,” when in fact the concern was unauthorized transfer of donor money.

2.

“…questioning the wisdom and legality of GB management in ‘transferring’ revolving funds to Grameen Kalyan…”

Analysis: Here Professor Muhammad Yunus indirectly admits legality was in doubt — acknowledging the action was not transparent.

3.

“…GB management always tried to ensure maximum transparency and optimum uses of its funds…”

Analysis: This claim is contradicted by reality: NORAD was not informed of the transfer until after it happened.

4.

“…The creation of Grameen Kalyan is basically to ensure maximum transparency and responsible uses of the revolving fund.”

Analysis: Highly ironic — creating a new entity without donor consent actually reduced transparency, not increased it.

5.

“…non-informing the Embassy of our actions immediately after the transfer, charging of interest and terms of repayment of loans from Kalyan to GB, non-inclusion of revolving fund account in the Annual Report of GB of 1996, question of reduction of the owners equity, use of the loan from Kalyan, effect on tax due to our action…”

Analysis: This is the most damaging part of the letter. Yunus himself lists major governance failures:

⬤ failure to report to NORAD,

⬤ omission from Grameen’s 1996 Annual Report,

⬤ questionable handling of equity,

⬤ and most critically: “effect on tax due to our action” — an outright admission that tax avoidance was a motive.

5.

“…It seems, we have failed to make our position clear to the embassy/NORAD…”

Analysis: Again, Dr. Yunus tries to reframe the controversy as a “miscommunication”, instead of taking responsibility for deliberate secrecy.

Why This Matters

This 1998 letter reveals a pattern:

- When caught, Yunus downplayed serious governance lapses as “misunderstandings.”

- He openly admitted that tax concerns influenced financial decisions.

- He prioritized protecting his institutions and personal reputation over transparency and accountability to both donors and the Bangladeshi people.

For someone celebrated as a global champion of the poor, avoiding taxes and hiding financial transfers undermines the very principle of serving the public good.

Yunus’s 1998 letter to Norad